Last Updated: March 10, 2022 | (En français)

Recovery UBI is a $500 monthly payment to all adults, which increases to guarantee each individual an income of $2,000/month ($3,000/couple, $1,500/additional adult in the family). According to a report by the Canadian Centre for Economic Analysis, Recovery UBI could lift 3.2 million Canadians families out of poverty – ending poverty – while growing our economy, creating hundreds of thousands of jobs, and supporting Canadian workers and businesses.

Recovery UBI would push Canadians beyond the bare minimum to make sure poverty is actually eliminated. It provides a universal dividend that helps Canadians at all income levels, not only those at the very bottom. It adds on top of current income supports rather than replace them.

Recovery UBI is a $500 monthly payment to all adults, which increases to guarantee each individual an income of $2,000/month ($3,000/couple, $1,500/additional adult in the family). According to a report by the Canadian Centre for Economic Analysis, Recovery UBI could lift 3.2 million Canadians families out of poverty – ending poverty – while growing our economy, creating hundreds of thousands of jobs, and supporting Canadian workers and businesses.

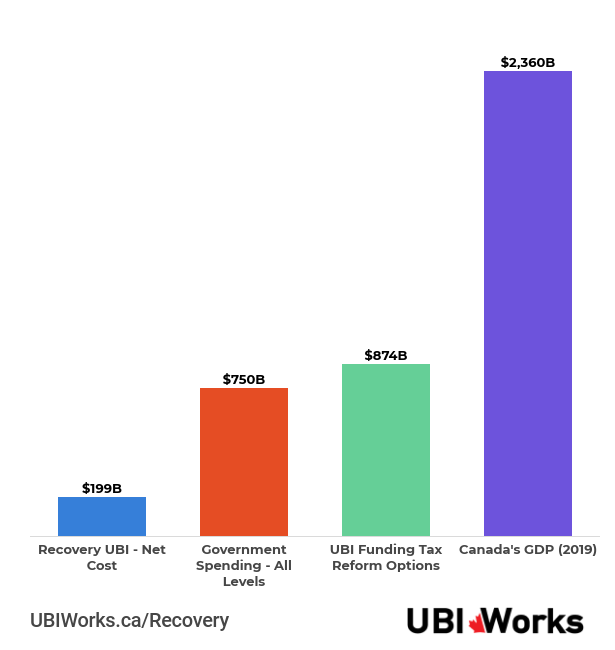

UBI Works has put together 8 ways to pay for Recovery UBI, drawn from a list of $874B in funding proposals from right across the political spectrum. They show that we can pay for a basic income without raising personal income taxes, without eliminating existing needs-based social programs, and without adding to the national debt.

Adopting and financing a Recovery UBI for Canada is merely a matter of political will.

Click here for a detailed list of these tax reform options.

Introduce a land value levy of 2.91% - $130,135,200,000.

Learn more: Assessing the potential revenue of Land Value Tax in Canada.

Joining Singapore, Denmark, Taiwan, Hong Kong - a levy on the value of land (not property) shares in the unearned appreciation of land value. 76% of our nation’s wealth is in real estate. A land value tax would slow the rise of property values and encourage more productive use of land, such as development of multi-family housing in valuable areas of our cities.

A 2.91% levy is less than the estimated 5.5% average annual growth of land value worldwide, and could be structured to be paid by equity (lien) rather than cash. A higher LVT could also be used to lower income taxes, replace property tax, and fund our cities.

LVT is called “the least bad tax” by economist Milton Friedman.

Financial Transaction (payment) Tax of 0.2% - $160,000,000,000.

Learn more: Implementation of a Microtax on Financial Transactions

A payment tax (or micro tax) applies a tax on all financial transactions undertaken within Canada. Payments Canada has estimated that there are $50 trillion in annual electronic financial transactions in Canada annually. This would reduce financial speculation and give all Canadians a share of our economy.

*This article will be updated throughout 2021 as new analyses are made. Follow this article for major ongoing updates.

We can ensure a more fair and fast economic recovery by giving a raise to all Canadians through a national universal basic income.

We call it Recovery UBI: a $500/month universal dividend, rising to a $2,000/month guaranteed minimum income (GMI) for individuals ($3,000 per couple and $1,500 per additional adult in the family).

This investment can be funded through tax reforms that appeal to a broad base of Canadians. In this article, we detail several such collections that have been proposed by both left- and right-leaning thinkers.

Our objective is to show that there are ample ways to fund a universal basic income—which you choose depends on what you think will have the best impact on Canada.

When the head of the World Economic Forum says “it’s time for a massive reset of capitalism” and the former Governor of the Bank of Canada, Stephen Poloz calls for an ongoing CERB-like mechanism to alleviate future economic shocks, it becomes clear that the time for band-aid solutions and incremental measures is over.

Our current system is making enormous sums of money; Canada’s GDP sits at over $2.3 trillion, but technology is pushing an increasing share of it out of the job market. Technology is the single most powerful enabler we have to create a better life for everyone on this planet, and UBI is how we organize ourselves to take advantage of it.

The cost of Recovery UBI is $199B/year. That provides every Canadian adult with an additional $500/month they can count on, no matter their circumstance. It further provides every individual with the security of a guaranteed minimum income of $2,000/month ($3,000/month per couple with $1,500 per additional adult in the family).

Basic income proposals have support right across the political spectrum. Most people can agree that direct cash transfers are the fastest, most efficient way to address poverty and give everyone a stake in an increasingly technology-driven economy.

UBI Works has compiled $874B worth of tax reform ideas that could pay for the Recovery UBI program cost 4 times over, and if you include temporary financing, nearly 7 times over.

Which options you choose depends on what you think will have the best impact on Canada. Tax reforms change the rules in a market economy: some can incentivize pro-social economic activity and disincentive unsustainable activities. Which reforms would you choose?

Click here for a detailed list of these tax reform options.

Many basic income proposals aim to replace the current social assistance landscape with a single, more generous and efficient program. These plans require intense, years-long coordination between all levels of government and careful, incremental implementation to ensure the many millions of people that rely on current programs are not negatively impacted.

Recovery UBI is designed to be a quicker, cheaper solution for the context of the current pandemic, while still allowing for a transition to permanent arrangement between the governments. It would immediately provide $500/month to every adult, ensuring all Canadians get the help they need when they need it: now.

It would further create a guaranteed minimum income, or income floor, that would increase the $500/month to ensure that it, along with existing government cash supports and all other income combined, is no less than $2,000/month (or $1,500 for those residing with family members also receiving it).

This postpones the need to account and negotiate for the complex and unintended interactions when combining multiple government programs, and ensures that Canadians can continue to rely on the vital supports they already receive. This way, we can be confident no one is accidentally left worse off.

The guarantee offsets the risk of losing income during the pandemic, such as getting laid off, as the monthly amount will rise if your income falls below $2,000. However, this mechanism can make the choice to go back to work more complicated as a larger paycheque will mean a lower Recovery UBI cheque.

Therefore, the program has a special feature; it only counts 50% of your employment income against the $2,000 guarantee. This ensures that at every income level, the choice to work will still earn you more money. For every dollar earned through employment, the income guarantee payment will only decrease by $0.50. If you are making enough that you don’t require the income guarantee, you still get an extra $500/month.

Because Recovery UBI is additive, and does not require consolidating dozens of provincial and federal programs, its net cost is much cheaper than a single, all-encompassing basic income, and something the federal government can roll out quickly and affordably to give all Canadians immediate relief.

After Recovery UBI is rolled out, we envision the universal dividend to increase each year until everyone receives the same amount - a true universal and unconditional basic income for all Canadians.

By reducing the number of Canadians living in or close to poverty, the demand for programs that support low-income individuals and families would shrink. This would happen automatically, as families rising incomes would mean they no longer need to access these programs.

Importantly, this can be accomplished without eliminating any of the needs-based programs that many people rely on, so that we can guarantee that the most vulnerable will not be left worse off. With more Canadians lifted out of poverty, provinces and territories would be able to better focus their social programs on addressing non-monetary needs and improving public services.

In addition to the direct program costs above, there are indirect cost savings that will come with the reduction of poverty. Feed Ontario has provided estimates on the healthcare and criminal justice costs that are associated with people living in poverty. Using their approach, we can estimate that a basic income could reduce healthcare costs by $17.7B and criminal justice costs by $3.9B across Canada. This leads to possible savings of $21.6B in these two areas alone.

Recovery UBI provides a platform on which the different levels of governments can eventually work together to implement common-sense consolidation of social programs to improve access, reduce cost, and ensure no one is left worse off.

“As business leaders, we see basic income as good economics and enlightened self-interest: it is a pro-growth, pro-business, pro-free-market economic stimulus that will grow the economy and create jobs. 1,000 economists in 1968 signed a letter endorsing a version of basic income.” - Letter by 120 Canadian CEOs addressed to Ontario Premier Doug Ford

Canada has already demonstrated that a national-scale basic income supports economic growth. Over 1.1M families are receiving at least $600/month from the Canada Child Benefit and 400,000 families are receiving at least $1,000/month right now.

The Canadian Centre for Economic Analysis showed that the increased spending driven by this basic income contributes $85B in business revenues, $24B in corporate profits, and 453,000 full-time equivalent jobs, every year, as well as increasing taxes from this economic activity.

From the the inception of the program in 2015 through the summer of 2019, the report showed:

“[T]he CCB’s contribution to GDP amounts to 2.1% of Canada’s total GDP. Every $1 disbursed through the program to Canadian families has translated to a $1.97 contribution to GDP, meaning that the economic activity generated by the CCB is almost twice the size of the CCB payments themselves. This economic stimulus also generates tax revenue which can help offset the cost of the program. For every $1 disbursed to Canadian families through the CCB, over half ($0.55) is recuperated through taxes, $0.30 to the federal government and $0.25 to provincial governments.”

It turns out that giving money to people with less is good for the economy:

“Families who receive CCB income contribute economic activity by spending this additional income according to their needs. In so doing, they increase the demand for certain goods and services, which creates ripples throughout the economy through indirect and induced effects. To fulfill the larger demand generated by the CCB, some businesses require more staff and workers, for example, additional store clerks, truck drivers, and supply chain managers.”

One limitation of this analysis is that it looks only at the gross contribution without considering where the money came from. Depending on the source of the money, the overall impact can vary widely. This all depends on how you pay for it, which we explore later in this article.

Given the return on investment from increased consumer spending on the economy and tax revenues, we do not actually need to raise $199B up front in new taxes to fund a $199B basic income. The goal should be to find the minimal upfront increase in taxes needed to achieve a payback period within a reasonable amount of time, when initially coupled with deficit-financing or direct funding via quantitative easing from the Bank of Canada.

For example, if you buy a house you plan to rent out for a profit, you pay some of the cost upfront and borrow the rest as a mortgage.This works because you know the rental income will help pay down your mortgage. The same principle can be applied to funding Recovery UBI, since UBI will grow the economy and generate a payback over time through greater tax revenues.

If you are wary of the option of direct financing from the Bank of Canada (BoC) instead of government debt financing, consider that BoC money creation is already being used right now to buy private corporate bonds and securities, propping up the stock market.

In fact, in 3 months the Bank of Canada created more money for asset purchases than the annual cost of RecoveryUBI. Using the central bank as a supplement for government financing is already used in economies such as the UK and is only a temporary measure. The BoC itself said in February, "[a] money-financed fiscal expansion can be more stimulative than a debt-financed fiscal expansion of equal magnitude.”

Maybe it is time to use this type of financing to directly support Canadians through our economic recovery rather than the stock market.

Recovery UBI is an investment in our people and our economy, and will create a return on investment that will partially pay for itself. UBI Works will commission an economic impact analysis from a leading economics analysis firm to find this upfront investment and payback period. Follow this article to be updated when that is made available.

Recovery UBI is an investment that can be funded in ways that appeal to a broad base of Canadians. Below, we explore various collections of tax reforms that could pay for Recovery UBI that reflect different priorities for where the money should come from, priorities that would require electoral politics to resolve.

The 8 collections of tax reforms presented below are by no means the only ways to fund Recovery UBI. In fact, we have identified over $874B in tax reform proposals suggested by both left- and right-leaning organizations over the years, and still more proposals may be feasible. If you feel we’ve missed any funding options, let us know. Explore these options yourself in our Recovery UBI funding options.

Recall from the previous section that a basic income partially funds itself through economic growth and reduced costs of government programs aimed at poverty reduction. Like any major investment in public infrastructure, a government would typically use temporary financing in anticipation of a return on investment from economic growth.

Therefore, for the options below, we take the $199B cost of Recovery UBI and further reduce it to $130B, after accounting for temporary financing of 35% ($69.9B/year) of the program through borrowing money or creating it from the Bank of Canada. This amount will be reduced every year as increased government revenues from economic activity offset the cost of the program.

The following collections all add up to close to $130B/year. If you don’t agree that temporary borrowing or money creation should be used to reduce initial tax burden, there are many combinations of tax reforms you can select that add up to $199B.

Introduce a land value levy of 2.91% - $130,135,200,000.

Learn more: Assessing the potential revenue of Land Value Tax in Canada.

Joining Singapore, Denmark, Taiwan, Hong Kong - a levy on the value of land (not property) shares in the unearned appreciation of land value. 76% of our nation’s wealth is in real estate. A land value tax would slow the rise of property values and encourage more productive use of land, such as development of multi-family housing in valuable areas of our cities.

A 2.91% levy is less than the estimated 5.5% average annual growth of land value worldwide, and could be structured to be paid by equity (lien) rather than cash. A higher LVT could also be used to lower income taxes, replace property tax, and fund our cities.

LVT is called “the least bad tax” by economist Milton Friedman.

Financial Transaction (payment) Tax of 0.2% - $160,000,000,000.

Learn more: Implementation of a Microtax on Financial Transactions

A payment tax (or micro tax) applies a tax on all financial transactions undertaken within Canada. Payments Canada has estimated that there are $50 trillion in annual electronic financial transactions in Canada annually. This would reduce financial speculation and give all Canadians a share of our economy.

Can you suggest better combinations of funding options? Background information and sources of all funding options are being maintained by UBI Works through volunteer contributions. Please join the effort and help improve this list of over $874B of funding options for a basic income in Canada.

Given what a Recovery UBI will do for you - eradicate poverty, grow the middle class, support communities’ businesses, use taxpayers’ money more efficiently, and grow the economy - its cost is a bargain. It is barely more than what we are already spending to support the economy during COVID-19 and, as the recession takes hold, that number will only grow.

Over the long term this program has the potential to pay for itself and free up much-needed funds for healthcare and education. How we pay for it in the short term is merely a matter of our national priorities. There are more than enough ways we can raise the money that will satisfy the values of all Canadians. We need only to tell our government and political parties that a Recovery UBI is a top priority - and if they act on it, they will earn our vote.

In another article, we show how to pay for a Guaranteed Basic Income of approximately $1,500/month without taxing the vast majority of Canadians, while encouraging economic growth.

To shift the conversation about basic income to recognize it as an economic need and economic opportunity, with the goal of seeing UBI implemented in Canada.

We want a Canada where everyone can pursue their potential and not be held back by basic material constraints or unsafe environments.

Sign up to become a Backer & Believer of Basic Income! Receive news and updates about UBI Works straight to your inbox.